Undoubtedly, for such pinnacle of achievement, public acclaim and an avalanche of incentives, monetary or otherwise, await Yulo as he leaves the City of Love. But would he leave Paris with hefty tax bills as well?

To answer this, it is imperative to assess the pertinent laws as it is a cardinal rule in taxation that tax exemption should be construed ‘in strictissimi juris’ (according to the strictest interpretation of the law) against the taxpayer and liberally in favor of the taxing authority.

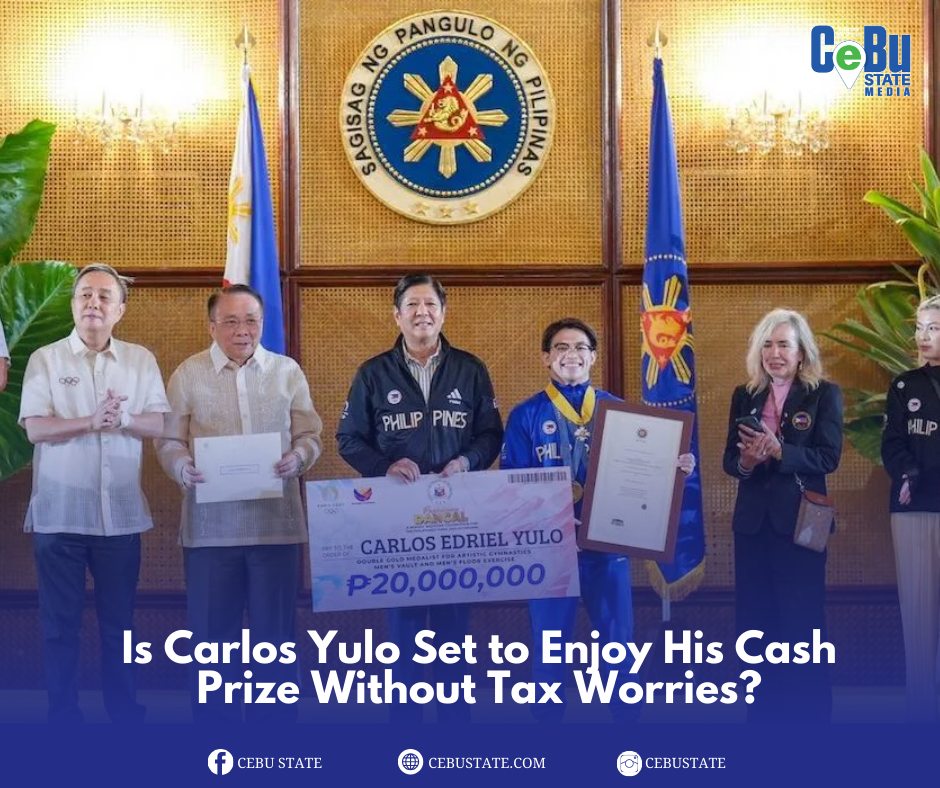

RA 10699 otherwise known as the “National Athletes and Coaches Benefits and Incentives Act”, provides that national athletes who have represented the Philippines and have won a gold medal in international sports competitions shall be entitled to cash incentives amounting to Ten Million Pesos (Php 10,000,000.00). Having won back-to-back gold medals, Yulo is slated to receive a total cash incentive of Twenty Million Pesos (Php 20,000,000.00). In addition, a national athlete who wins in an international competition is entitled to a lump sum amounting to twenty-five percent (25%) of his/her total cash incentives computed from the start of his/her active sports career as a member of the national training pool up to the last day of retirement from active competition or training as certified by the Philippine Sports Commission. The amount necessary for the implementation of the said cash incentives and retirement benefits under this law shall be taken from the net cash income of the Philippine Amusement and Gaming Corporation (PAGCOR), to be remitted directly as a special account to the National Sports Development Fund (NSDF) of the Philippine Sports Commission.

However, upon perusing the law and its implementing rules and regulations, nowhere did it state or imply that the said cash incentives are tax exempt. Even its corresponding Revenue Regulation No. 13-2020, dated May 27, 2020, was interestingly silent about the tax implications of the cash incentives, focusing rather on the implementation of the 20% discount privileges that every qualified national athlete ought to enjoy, whether or not he or she wins a medal, and the manner to which the qualified establishments may claim said discounts as a tax deduction based on the net cost of goods sold or services rendered.

Nevertheless, we may be guided by Section 32[B][7][d] of the National Internal Revenue Code (NIRC), which considers the following to be an exclusion from the gross income:

“All prizes and awards granted to athletes in local and international sports competitions and tournaments whether held in the Philippines or abroad and sanctioned by their national sports associations.”

This section, however, should be read in relation to the provisions of Republic Act (R.A.) 7549 which reads:

“All prizes and awards granted to athletes in local and international sports tournaments and competitions held in the Philippines or abroad and sanctioned by their respective national sports associations shall be exempt from income tax: Provided, That such prizes and awards given to said athletes shall be deductible in full from the gross income of the donor: Provided, further, That the donors of said prizes and awards shall be exempt from the payment of donor’s tax.”

Moreover, Section 2 of the said Act provides that the term “national sports association” shall mean those duly accredited by the Philippine Olympic Committee.

In Bureau of Internal Revenue (BIR) Ruling DA-038-05 dated January 28, 2005, the Bureau ruled that Section 32(B)(7)(d) of the NIRC and R.A. 7549 must be construed as harmonious parts of one law; the former being of a general character, the latter being of a special nature. Hence, R.A. 7549 must be treated as a special qualification of Section 32(B)(7)(d) of the NIRC.

Applying the precepts of the aforequoted laws to Yulo’s case, considering that he is an athlete who won in the Summer Olympics, the participation of Filipino athletes is duly sanctioned by the Philippine Olympic Committee, the Twenty Million Pesos (Php 20,000,000.00) cash prize granted to Yulo is exempt from income tax.

This differs from the case experienced by International Chess Grandmaster Rogelio M. Antonio, Jr. (“GM Antonio”) where the Philippine Chess Federation withheld 20% of the cash prize awarded to him for winning the first Pambansa Millennium Chess Grand Prix.

Quoting the provisions of R.A. 7549, GM Antonio adamantly refused to accept the reduced prize and sought exemption from income tax. However, the BIR, in denying said request for exemption, ratiocinated that Section 2 of R.A. 7549 limits the application of the law only to prizes and awards granted to athletes in sports tournaments and competitions sanctioned by their respective national sports associations that are duly accredited by the Philippine Olympic Committee. Considering that the sports association that organized and sanctioned the Millennium Chess Tournament was not duly accredited by the Philippine Olympic Committee, it followed that the prizes won in the said tournament were not exempt from income tax.

Donations from private individuals and corporate entities.

Carlos Yulo is slated to be granted, among others, a fully furnished three-bedroom condominium unit valued at Thirty-Two Million Philippine pesos, by MegaWorld, a brand new car by Toyota, free franchise by Don Macchiatos, lifetime meals pledged by Vikings, Cabalen, Hagemu Sushi and BOK Korean Fried Chicken, and an indeterminate amount of cash from various individuals and entities.

These generous donations given to Yulo by the aforementioned business entities shall not be included in Yulo’s gross income and shall be excluded from the computation of Yulo’s gross income pursuant to Section 32 (B)(3) of the NIRC, which provides:

“(B) Exclusions from Gross Income. – The following items shall not be included in gross income and shall be exempt from taxation under this title:

xxx

(3) Gifts, Bequests, and Devises. – The value of property acquired by gift, bequest, devise, or descent: Provided, however, That income from such property, as well as gift, bequest, devise or descent of income from any property, in cases of transfers of divided interest, shall be included in gross income.”

However, the private individuals and entities who donated shall be subject to the 6% donor’s tax in excess of Two Hundred Fifty Thousand Philippine Pesos (Php 250,000.00). Their donations in money, services and in kind bestowed to Yulo are outside the ambit of RA 7549 as they do not qualify as a prize or award as contemplated by law, but by their nature, are considered as donations.

Future Trends and Considerations

The House of Representatives approved a measure to exempt from taxes not just the donations granted after the win, but also donations received by athletes one year prior to the date of competition.

Albay Representative Joey Salceda believes that “the prize is never won on the day of the competition itself, but years before. Hard work, determination and sheer grit through many years of training wins over talent.” he further added that what needs to be done is to “incentivize the investments being made on the athletes who are still working on winning medals for the country.” As of date of writing, this is currently pending.

If you have any queries on taxation law in general, or any similar issue on the matter, feel free to reach out to us at GMD Law.

About the writer:

A Certified Public Accountant (CPA) and a young attorney with a diverse practice spanning corporate law, intellectual property, and technology law. Drawing on her dual expertise in law and finance, Kim Elaine provides comprehensive counsel to businesses seeking to navigate the legal and financial complexities of the modern marketplace. She is adept at structuring business transactions, protecting intellectual property rights, and advising on regulatory compliance in the technology sector. Kim Elaine’s innovative approach to legal challenges and her commitment to delivering practical solutions tailored to her clients’ needs make her a valuable asset in today’s rapidly evolving business landscape.

About GMD Law:

GORDON MORA DIAMANTE is a multi-disciplinary firm rendering end-to-end business support, enabling services and intervention processes by engaging clients from conception, birth to growth and innovating, restructuring as well as giving birth to new but evolving business ideas, all revolving around the business life cycle.

Email Us: info@gmdlaw.ph